The regulatory reforms that followed the financial crisis of 2007-09 created a financial system that is far more resilient than the one we had 15 years ago. Today, banks and some nonbanks face more rigorous capital and liquidity requirements. Improved collateral rules for market-making activities can dampen shocks. And, some institutions are subject to well-structured resolution regimes.

Yet, the events of March 2023 make clear that the system remains fragile. The progress thus far is simply not enough. What else needs to be done?

In a new essay, we address this critical question. Our assessment of the banking system turmoil of 2023 leads us to several obvious conclusions, some of which clearly escaped both bank managers and their supervisors. Perhaps the simplest and most significant is that banks can survive either risky assets or volatile funding, but not both. Another is that supervisors are willing to treat some banks as systemic in death, but not in life.

We also draw two compelling lessons from the recent supervisory and resolution debacles. First, a financial system which relies heavily on supervisory discretion is unlikely to prove resilient. Second, authorities with emergency powers to bail out intermediaries during a panic will always do so. That is, policymakers are incapable of making credible commitments to impose losses on depositors and others. In our view, the only way to address this commitment problem is to prevent crises.

Based on our analysis, we develop a list of deficiencies in the current system. We then proceed to enumerate principles for making the regulatory framework more robust. Finally, we evaluate a series of proposed reforms by asking whether they address the identified deficiencies and meet the principles. In this post, we summarize the existing deficiencies, the principles for reform, and our evaluation of some specific proposals for making the financial system more robust. To anticipate our recommendations, we argue that authorities should:

Significantly increase capital requirements

Strengthen and simplify liquidity requirements

Shift to mark-to-market accounting

Improve the transparency, flexibility and severity of capital and liquidity stress tests.

(See also our recent post regarding the new NYU Stern e-book: SVB and Beyond: The Banking Stress of 2023.)

Deficiencies of the current system. Starting with the system’s inadequacies, first and foremost, as we saw yet again, uninsured deposits are prone to runs. Moreover, due to advances in communications and technology, a run can now overwhelm a bank within hours, transforming almost immediately into a system-wide panic.

Second, even in the case of simple banks like the Silicon Valley Bank (SVB), which was the first to fail in March 2023, supervisors have a very difficult time identifying risks in real time. And, when they do, enforcement is still a challenge, reflecting both a high burden of proof on the supervisor and a coordination problem within and across agencies. For more complex banks that have numerous means for concealing risk taking, detection is substantially more difficult.

Third, authorities’ regulatory preferences evolve. One official’s view about what is required or advisable will almost surely differ from that of their predecessor and successor.

Fourth, the presence of highly illiquid assets on banks’ balance sheets makes the measurement of capital levels extremely difficult. Ideally we would like to have a forward-looking measure of a bank’s economic value. In lieu of this, we need to improve accounting rules to ensure that reported measures of regulatory capital are not absurdly inaccurate, especially during times of stress.

Fifth, soft-touch regulation of nonbanks that engage in bank-like activities encourages risk-shifting away from banks. The dearth of regulation and supervision that is based on the principle “same activity, same risk, same regulation” remains a serious problem.

Finally, some managerial compensation schemes encourage risk taking at the expense of depositors, bondholders and taxpayers. When a bank is very short of capital, these arrangements can encourage gambling for resurrection.

Principles of a robust regulatory framework. Turning to principles, we start with the fact that regulation should be rule-based. Rules have a broad range of benefits. They address the commitment problem by narrowing supervisory discretion. They are less likely to change when officials’ preferences change. They are more credible since it is clear when authorities are following them and when they are not. They make it easier to identify violations of well-specified rules and enforce remedies. Finally, a set of well-defined rules may make it possible to apply the same regulatory and supervisory standards to nonbanks engaging in bank-like activities based on the principle of “same activity, same risk, same regulation.”

Second, a robust framework is simple and transparent. Since examiners on the ground inevitably have checklists that they are going to use to assess compliance, simplicity and transparency are essential for effective enforcement. Beyond that, it promotes market discipline as they create an environment where external monitoring is more reliable.

Third, a robust framework must have stringent standards. Ensuring sufficiently large capital and liquidity buffers has a range of advantages. First, large buffers anticipate the inevitable gaming associated with a set of stable rules. That is, they help counter regulatory arbitrage. Second, by making insolvency and illiquidity less likely, they reduce the risk of bailout. Third, high levels of capital and liquidity substitute for unavoidable weaknesses in discretionary supervision. Fourth, regardless of the accounting standards in place, large buffers guard against uncertainties in asset valuations that can lead to overestimation of actual net worth.

Finally, a robust framework is efficient in its use of resources. When multiple agencies have the same responsibility, it can make agreement on sanctions difficult, and delay their enforcement. Consequently, we are persuaded the system should be as streamlined as possible (see, for example, the Volcker Alliance).

Finally, the most important property of a robust framework is that, by limiting the spillovers to the broader financial system and the real economy, it allows banks to fail in an orderly way.

Evaluating Proposed Reforms

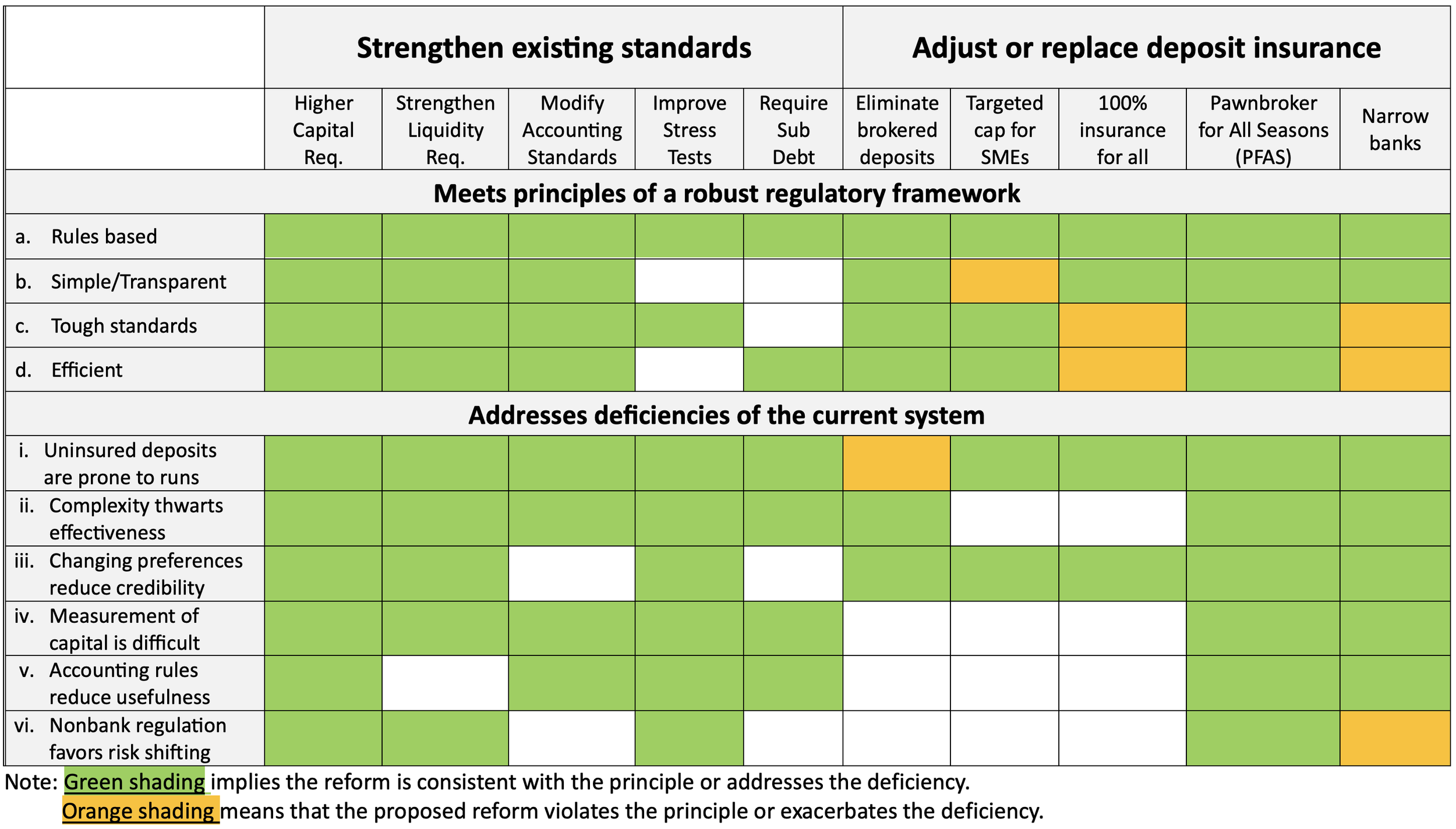

Table 1 summarizes our evaluation of a range of possible regulatory reforms. Each column reflects a specific proposal, while the cells reflect our assessment of whether that proposal addresses the deficiencies of the current system or is consistent with the principles for robust regulatory reform that make up the rows of the table. We use green shading when we believe the answer to the question is yes, white when it is no, and orange where we believe the proposal is counterproductive.

Table 1. Evaluating Proposals for Regulatory Reform

In our longer essay we address all these proposals. For the sake of brevity, here we focus only on those that strengthen existing standards, best address the deficiencies, and are fully consistent with the principles for reform.

Raise and simplify capital requirements for banks and nonbanks. This straightforward proposal increases loss absorbency, reducing the likelihood of insolvency for any specific adverse valuation shock. Done well, it can meet all the principles: it is clearly rule based; it should be simple and transparent; by making the requirement high enough, it is tough; and, it should be relatively efficient. Importantly, while requiring more capital is privately costly, within a range of up to, say 15% of total assets, we doubt that it is socially costly (see, for example, our earlier post). Consequently, while we welcome Federal Reserve Vice Chair for Supervision Michael Barr’s recent proposal to broaden and raise capital requirements, we believe that policymakers should raise these requirements much further than Barr plans.

As for addressing the deficiencies of the current system, a larger capital buffer makes banks less run prone; reduces complexity; lowers the impact of authorities’ changing preferences; addresses the difficulties in measurement and accounting; and, if applied comprehensively to institutions engaged in banking activities, reduces incentives for risk shifting.

With respect to interest rate risk, the current Basel III standard relies on the discretion of the supervisors to adjust a bank's capital requirement for securities that are not marked to market (e.g. “held to maturity”). In light of the 2023 banking turmoil and of past episodes (such as the savings & loan crisis in the 1980s), interest rate risk should be included in the nondiscretionary portion of capital requirements.

Strengthen and simplify liquidity requirements. The current liquidity coverage ratio (LCR) seems woefully inadequate. The LCR requires banks to hold reserves and government securities sufficient to cover outflows in a 30-day stress scenario (see our earlier post). However, it assumes a run-off rate of 10% within 30 days for uninsured deposits, whereas virtually all SVB’s deposits either fled or sought to flee within 24 hours!

One possibility is to make the assumed runoff rate sensitive not only to the volatility of the liability but also to a bank’s (properly measured) net worth (see, for example, Richardson, Savov and Schnabl, Chapter 3 in Acharya et al.). For banks like SVB, such an LCR could have compelled reduced reliance on uninsured deposits nearly a year before the bank failed. Put differently, such a capital-sensitive runoff assumption directly addresses the fatal compound risk that felled SVB and other midsized banks.

As noted in the second column of Table 1, a strengthening of liquidity requirements is consistent with all our principles, and addresses all deficiencies except for the challenges associated with accounting rules (which distort the valuation of capital, not liquidity).

Modify financial accounting. To ensure that regulatory capital more accurately reflects each bank’s true financial condition, it is essential that authorities change accounting standards. Fluctuations in the market price of securities on their balance sheets ought to have considerable influence on banks’ regulatory capital. While we prefer a mark-to-market or fair value approach, an intermediate solution is for banks, which already report unrealized losses on their securities, to report an “adjusted” measure of their net worth for use by the FDIC to ensure “prompt corrective action” (the timely resolution of a poorly capitalized bank). Making the adjusted measure prominent in public disclosures also shines a bright light on capital adequacy and, hopefully, spur both market and supervisory discipline.

As the third column of Table 1 highlights, mark-to-market accounting is consistent with all the principles and helps address most of the deficiencies in the current system.

Improve stress tests. The theory underlying stress tests is that when a large common shock hits, there is no one to whom a bank can sell assets or from whom it can raise capital. Ensuring that each systemic intermediary can withstand significant stress raises the likelihood that the system will continue to provide critical financial services. To be useful, stress tests need to be transparent, flexible, and severe.

To enhance the effectiveness of stress tests, we recommend four changes. First, as the Federal Reserve now recognizes, there should be multiple adverse scenarios, not just one. Second, to ensure the proper incentives, managerial compensation should be linked to the outcome. Third, because it is difficult to model the amplification that results from banks’ initial responses to adverse shocks, the severity of some of the scenarios should be outside of historical experience. Finally, stress tests should focus on banks’ most profitable activities, as these are likely to reflect greater risk exposure.

Looking at the principles, stress tests fail in the sense that they are not simple, they depend on supervisory insight and discretion, and their resource intensity means they are not efficient. However, as Table 1 highlights, improved stress tests can help address all the deficiencies.

Conclusion. While financial intermediaries and the financial market infrastructure are far more robust than they were 15 years ago, the events of 2023 brought to light the lingering vulnerabilities of the financial system. In this post, and our longer essay, we provide a framework for evaluating proposed reforms that leads us to recommend strengthening capital and liquidity requirements, modifying accounting standards, and improving stress tests. We hope that international standard setters and domestic authorities work expeditiously to design and implement each and every one of these changes.