“Global banks are global in life but national in death.” Mervyn King

Courses in international economics usually introduce students to the impossible trinity, also known as the trilemma of open-economy macroeconomics: namely, that a fixed exchange rate, free cross-border capital flows, and discretionary monetary policy are incompatible (see left panel of diagram). Why? Because, in the presence of free capital flows under a fixed exchange rate, private currency preferences (rather than policymakers) determine the size of the central bank balance sheet and hence the domestic interest rate. We’ve highlighted this problem several times in analyzing China’s evolving exchange rate regime (see here and here).

While many students learn that a country can only have two of the three elements of the open-economy trilemma, few learn that there also exists a financial trilemma. That is, financial stability, cross-border financial integration, and national financial policies are incompatible as well (see right panel of diagram). The logic behind this second trilemma is that increases in financial integration reduce the incentives for national policymakers to act in ways that preserve financial stability globally. Put differently, as the benefits from financial stability policies spread beyond borders, the willingness to bear the costs of stabilizing the system at the national level decline. This has the important implication that, if we are to sustain increasing financial integration, then we will need greater international coordination among national financial regulators (see here, or for a much broader case for international economic governance, see Rodrik). While this conclusion applies widely, nowhere is it more true than inside the euro area, where policymakers would like a fully integrated financial market, but still protect national champions (including financial intermediaries as well as exchanges).

The two trilemmas

Source: Authors.

We credit Dirk Schoenmaker as the most effective expositor of the financial trilemma (see his book-length study, Governance of International Banking). In the simple Schoenmaker model, the problem arises from comparing the benefit (B) and cost (C) of stabilizing a bank in a crisis. Stabilization benefits the economy by avoiding a trigger for financial contagion and, as a result, helps to sustain the supply of credit and economic activity. The costs are those imposed on taxpayers when the public sector recapitalizes weak banks, as occurred with most of the bailouts in the 2007-2009 crisis. (Long-run costs of bailouts—such as the banks’ increased incentive to take systemic risk—are outside the simple model, but could presumably be included for a regulator with a long horizon.)

In the case of a purely domestic bank, a regulator compares these simple costs and benefits, choosing to implement a publicly-supported resolution whenever the benefits (B) exceed the costs (C). Otherwise, the authorities will shut the bank down, allowing the shareholders and counterparties to bear the losses. However, the larger the share of the failing bank’s foreign activity (s), the more that foreigners, rather than domestic residents, reap the benefits of a recapitalization. In the absence of international cooperation, the domestic regulator compares the domestic benefits of stabilization, that is (1-s)*B, to the (purely domestic) cost (C) of stabilization. While a recapitalization would secure global financial stability whenever total benefits exceed costs (B>C), national regulators will only implement a public recapitalization whenever domestic benefits exceed costs [(1-s)*B>C]. If instead, benefits to foreigners are a sufficiently large portion of the total, so that (1-s)<C/B, national authorities will choose to close the bank, risking contagion and global financial instability.

Mervyn King’s paradox—stated pithily in the opening quotation—highlights this conflict between global and national benefits and costs in addressing the failure of global banks. What this means is that, ultimately, only two regimes are consistent with financial stability: one with extensive cross-border banking and one with relatively little. But the first requires extensive cooperation and coordination among national regulators. This coordination must be pre-arranged and credible; it cannot be reliably organized in an ad hoc fashion during a crisis when regulators have neither time nor inclination to negotiate one-off burden-sharing arrangements. The second regime requires no coordination, as the incentives of national regulators are sufficient to promote stabilizing policy responses in a crisis (that is, whenever B>C); but such a system forgoes the benefits of cross-border finance.

In our view, the financial trilemma applies well beyond the Schoenmaker problem of an appropriate mechanism for sharing the costs associated with the resolution of global banks. One reason is that global banks are not the only sources of potential cross-border instability. Systemic risks also can arise from, or be transmitted by, the bank-like activities of nonbanks (consider the impact of the U.S. money market fund exit from the euro area at the height of the crisis), the behavior of run-able leveraged open-end funds holding illiquid instruments (such as corporate bonds or emerging market assets), and vulnerabilities in the financial architecture itself (especially payments, settlement and clearing arrangements); to name just a few.

Another concern is that, in order to limit the likelihood of a financial crisis, the costs to ensure financial resilience must be pre-paid in good times (say, through capital and liquidity requirements). If the benefits of preventing a crisis spill over abroad (as the resolution benefits do in the Schoenmaker model), the incentive for national regulators to pre-pay for crisis prevention will be lower.

Of course, the problem of the financial trilemma only arises if the global financial system is sufficiently integrated. Just how integrated is it? At the broadest level, the simple answer is: as much as ever. However, the pattern of rapid increases in integration from 1980 to 2007 did halt with the financial crisis. And, since 2007, one element of integration in advanced economies—the cross-border activity of banks—has diminished (see Lane and Milesi-Ferretti).

The chart below reports a broad gauge of financial integration for which we have a long history: the ratio of external assets and liabilities to GDP. By this measure, what Obstfeld and Taylor call “the second wave” of globalization began around 1980 and far surpassed “the first wave,” which was associated with the pre-World War I classical gold standard. As the latest BIS Annual Report highlights, the financial globalization of the past 40 years has contributed to improved living standards by providing support for international trade and investment, and by improving resource allocation and risk management. At the same time, the net benefits would be substantially larger if key costs, such as the international transmission of crises that financial globalization facilitates, were better managed.

Global external assets and liabilities (Percent of GDP), 1825-2015

Source: BIS, 2017 Annual Report, Graph VI.2.

Narrowing our perspective to the United States, we see a similar pattern. External activity expanded sharply from 1980 to 2007 (see chart). Since then, external assets have ranged between 128 and 143 percent of GDP, or more than five times higher than in 1980. Interestingly, since the financial crisis, the composition of U.S. external assets also shifted notably, with rapid increases in portfolio holdings and foreign direct investment (FDI) mostly offsetting a plunge of derivatives and a smaller decline of debt. This shifting mix at least partly reflects the post-crisis deleveraging of internationally active U.S. banks. As Lane and Milesi-Ferretti document, something similar has happened in Europe, where the euro-area crisis has led banks to pull bank from their cross-border activity.

U.S. external assets (Percent of GDP), 1970-2015

Source: Philip R. Lane and Gian Maria Milesi-Ferretti (2017), “International Financial Integration in the Aftermath of the Global Financial Crisis,” IMF Working Paper 17/115.

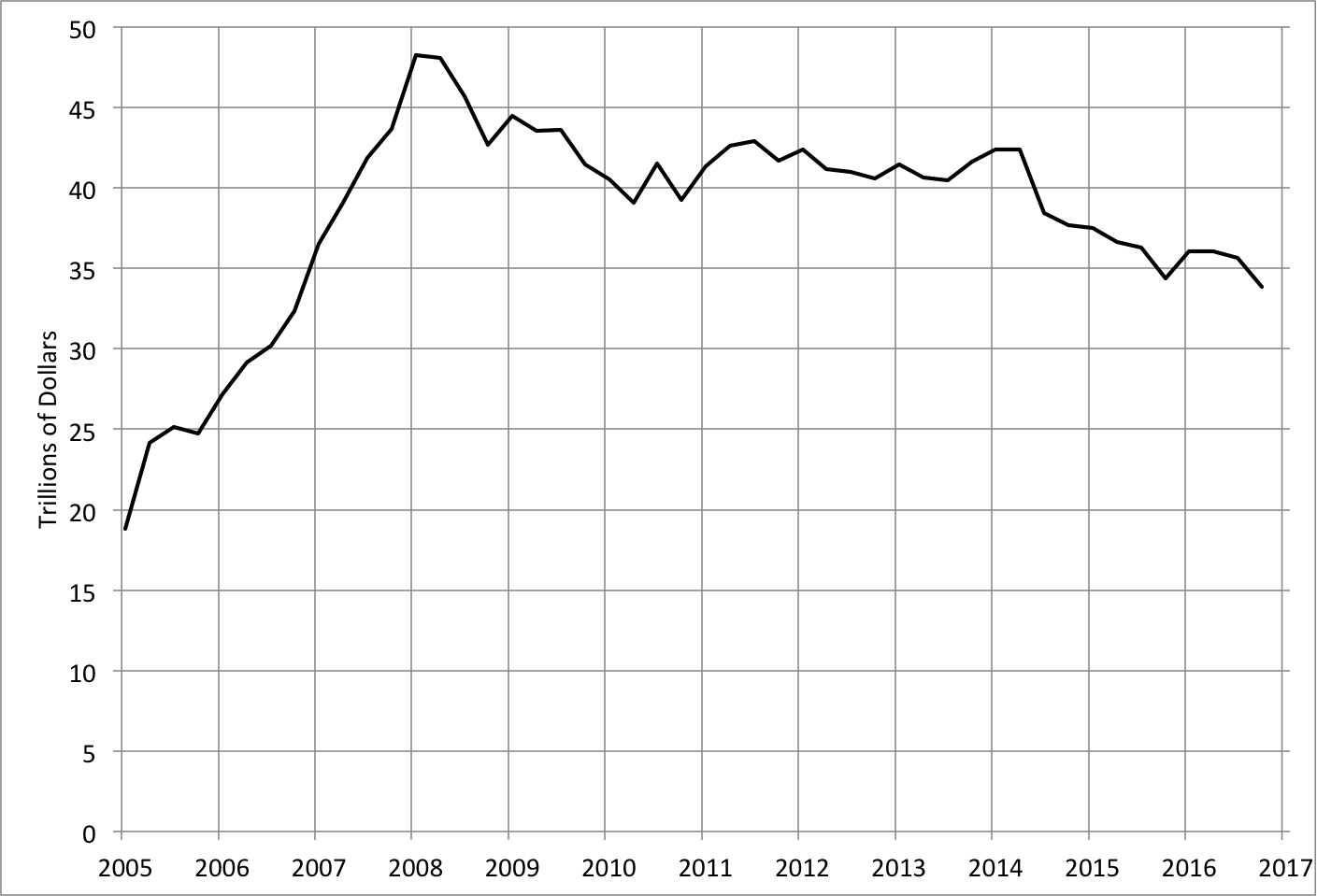

The retreat of banks from international activity is especially evident in the recent evolution of foreign claims and other potential cross-border exposures. While data is available only since 2005, this broad measure has declined from a peak of $48 trillion in early 2008 to less than $34 trillion at the end of 2016 (see chart). Nevertheless, the most recent figure is still nearly double the level of what it was just a dozen years ago, and is equivalent to 45 percent of world GDP.

Foreign claims and other potential exposures (Trillions of U.S. dollars), 2005-2016

Note: Other potential exposures include derivatives, guarantees extended, and credit commitments. Source: BIS consolidated banking statistics (ultimate risk basis; Table B3).

So, where does this leave us? To which of the financial trilemma’s long-run equilibria are we headed? Will we go to one that preserves or further expands the already high level of integration? Or, will we go to one in which regulators and intermediaries withdraw further behind national boundaries to ensure stability? Or, will we maintain a worrisome, unstable mix—like the current one—where the imbalance of advanced international integration and national regulation leaves us vulnerable to further financial disruptions arising both domestically and abroad?

Here, the signals are mixed. On the positive side, acting through international standard-setting bodies like the Basel Committee on Banking Supervision (BCBS) and the Financial Stability Board (FSB), in the decade since the financial crisis began, national regulators have cooperated to elevate the capital and liquidity standards for the largest, cross-border players—the global systemically important banks (G-SIBs). They have also made considerable progress in identifying and measuring shadow banking activity (see the latest FSB report). At the same time, the falling cost of cross-border transactions—supported by rapid technological gains—is motivating financial firms to seek business opportunities in any jurisdiction where they can find them. Finally, within the euro area, policymakers have made some progress toward a banking union (albeit, without a common deposit insurance scheme and adequate resolution funding).

Nonetheless, as we have argued in the past, the danger of financial fragmentation persists. Regulators cannot be confident that the capital, liquidity, and resolution arrangements in place today are sufficient to prevent another crisis. And, because problems can spread rapidly across borders in an integrated world, the financial trilemma tells us that national regulators must care deeply about the resilience of others’ financial systems. They also need to know if innovations elsewhere will allow firms to circumvent common rules. Consequently, greater cooperation and information sharing will almost surely be needed just to maintain the status quo of high integration.

Considering its long-run benefits, we hope that the financial trilemma will be resolved in favor of more, not less, financial integration. But, if coordination turns out to be inadequate, or if the relevant information about other jurisdictions proves difficult to verify, then the instinct will be to retreat. We are already starting to see this withdrawal as authorities require that otherwise global firms ring-fence their assets, capital and liquidity inside national borders. Should that continue, it would be a sadly inefficient way to resolve Mervyn King’s paradox.