"That [comparative advantage] is logically true need not be argued before a mathematician; that it is not trivial is attested by the thousands of important and intelligent men who have never been able to grasp the doctrine for themselves or to believe it after it was explained to them." Paul Samuelson

Governments play favorites. They promote residential construction by making mortgages tax deductible. They encourage ethanol production by subsidizing corn. They boost sales of electric cars by offering tax rebates. These political favors usually diminish, rather than increase, aggregate income. They’re about distribution, not production.

With the ascendance of Donald Trump to the presidency, U.S. government intervention has taken a particularly troubling turn. Not only has he threatened companies planning to produce their products outside of the United States, but he has appointed strident free-trade opponents (ranging from China-bashing Peter Navarro to trade-litigator Robert Lighthizer) to key positions in his administration. In his first week in office, President Trump has pulled the United States out of the Trans-Pacific Partnership (TPP) and moved to renegotiate the North American Free Trade Agreement (NAFTA). His representatives also have threatened to impose tariffs on Mexico (and other countries). In what seems like the blink of an eye, these actions have sacrificed the valuable U.S. reputation–earned over seven decades since President Truman—as a trustworthy leader in the global fight for open, competitive markets.

Historically, government guidance of the economy has come in many forms, ranging from carefully planned industrial policies intended to allocate resources to activities where there is a claim of long-run efficiency to the chaotic attacks of the new U.S. Administration. The evidence suggests that the former doesn’t work, while the latter is largely propaganda that undermines property rights, creates unnecessary risk, and diminishes the incentives to invest.

Before proceeding, let’s start with a few key facts about trade and employment. Starting with global trade, over the past quarter century, international trade measured by the sum of imports plus exports, has risen from less than 40% to nearly 60% of global GDP. By this measure, the world is more open today than it has been since at least 1830.

Expansion of trade has brought immense benefits to the people of the United States. Much of their clothing comes from abroad, as do many of their household appliances, furniture and foodstuffs. Consumers chose these imported goods because of their attractive prices. For the most part, that price competitiveness arises from the simple, but profound notion of comparative advantage that David Ricardo developed in 1817, exactly 200 years ago: countries tend to export those goods and services that they can produce with lower opportunity cost (or, in a more recent formulation, for which they are better endowed with the key production inputs).

This brings us to our first conclusion: the benefits of voluntary trade are widely visible in the form of lower prices and greater variety. While boosting standards of living generally, reducing the cost of the consumer basket contributes especially to the welfare of the least well-off. (If you doubt it, check out the competitive offerings at Walmart or Costco, which together account for nearly one-tenth of U.S. retail sales excluding cars!)

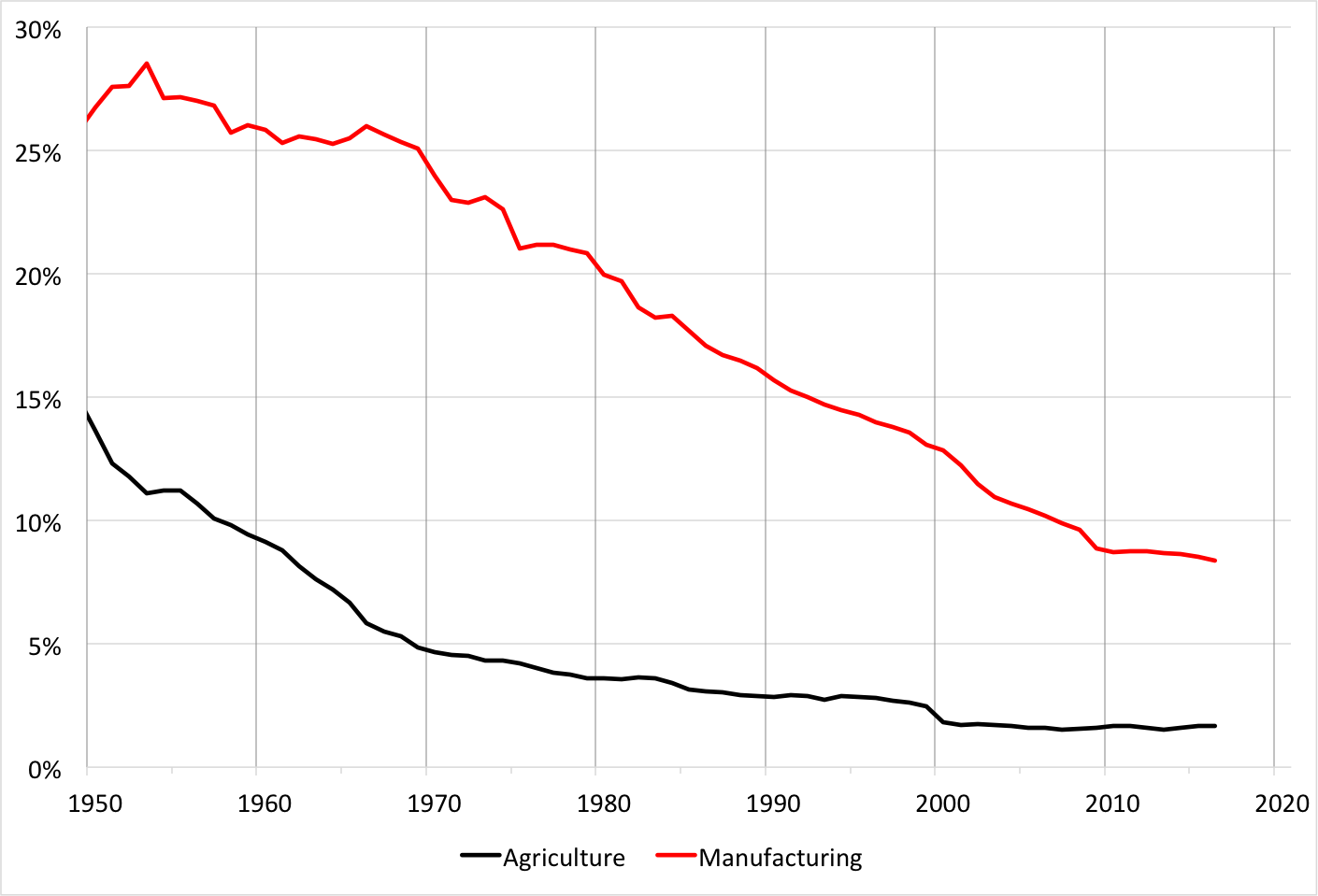

Turning to employment, as is well known, for many decades there has been a steady shift from manufacturing to services virtually across the advanced economies. In the United States, the share of employment in manufacturing has fallen from 27 percent in the mid-1950s to 8 percent today. This sustained decline mirrors a pattern in agriculture, where the employment share has gone from just under 15 percent in 1949 to less than 2 percent (see chart). Back at the start of the 20th century, 40 percent of the U.S. workforce was in agriculture (see here).

Agricultural and manufacturing shares of total employment, 1950-2016

Source: FRED.

This persistent shift in employment patterns has multiple causes, with technological change (rather than trade) at the top of the list. To be sure, the shock of China’s rise since 1990 to the top of global manufacturing has been important. Yet, over the post-World War II period, it is better machines and improved production processes that have displaced most U.S. manufacturing workers, not foreign workers. Indeed, even as employment has fallen, output has grown, boosting manufacturing productivity by a factor of five since 1947 (see next chart).

Value-added in manufacturing per worker (2009 U.S. dollars), 1947-2015

Sources: BEA, BLS and authors’ calculations.

As mechanization continues to increase, some factories that went abroad may well return. But that is unlikely to arrest, let alone reverse, the sustained drop in the employment share. Reshoring, as it has been called, lowers both political risk and transport costs. But, the work will be done increasingly by ever-more sophisticated expert systems and robots, not people. Some of the U.S. firms recently called out by then President-elect Trump probably anticipate that such labor-saving technologies will limit their costs of producing in Indiana or Michigan despite Mexico’s lower wages.

So, what about industrial policy? Is there some comparative advantage in U.S. manufacturing that only insightful policymakers can identify that otherwise would be neglected by private investors and capital markets?

Since Ricardo’s defense of free trade, people have proposed a range of rationales for shielding their domestic industries from the threat of foreign competition. These include claims that: (1) infant industries need protection if they are to flourish into globally competitive adults; (2) some industries have positive spillovers that can only be captured if they are on domestic soil; and (3) complementarities between upstream suppliers and downstream producers require coordination which only the government can catalyze.

Yet, each of these arguments suffer from weaknesses in theory or practice (see, for example, here). Prime among them is that private citizens in a large, competitive economy have enormous incentive to identify and invest in enterprises that will be profitable in the long run. If, on the other hand, an industry can flourish only after the development of some general-purpose technology over which it cannot maintain intellectual ownership, then the government should be funding R&D, not protecting the industry itself.

Theoretical arguments aside, the principal difficulty with industrial policy is in implementation. For many years, advocates held up Japan’s Ministry of International Trade and Industry (MITI) as exhibit A in favor of industrial policy. For decades after the devastation of World War II, MITI helped guide industrial investment in Japan. As it did, the economy grew at a 7 percent annual rate from 1955 to 1985. But was this impressive performance a result of MITI’s interventions? The short answer is no. In their seminal study of Japanese industrial policy published in 1996, Beason and Weinstein show that policymakers favored firms in low-growth sectors with decreasing returns to scale. The fact is that the largest subsidies went to mining and textiles, not automobiles and electronics. Like other forms of distribution policy, this amounted to compensating the losers, not promoting the winners.

When it comes to government intervention—be it industrial policy or otherwise—it should come as no surprise that politics gets in the way of economics. As Luigi Zingales recently noted, there is an enormous difference between promoting markets and promoting businesses. The former creates a framework for aggregate expansion: favoring efficiency and growth that, in turn, raise welfare. The latter helps inefficient firms protect their position from the threat of competitors. Foreigners are an easy target for these weak incumbents, appealing to people’s patriotic predispositions even when it not in their collective economic interest.

We could stop here and simply conclude that we are concerned that the Trump Administration has embarked down a road that will protect high-cost inefficient firms and industries under the guise of saving jobs. In the short term, this will drive up prices; in the long run, it won’t save jobs. But the situation is much worse than that. Presidential threats circumvent orderly legal processes, making the United States a less attractive place to invest. Who is going to enlarge their business if shrinking or moving it risks incurring the Commander in Chief’s wrath? Will U.S. global competitiveness decline because the Administration is making it riskier to do business across borders?

If the new government wishes to boost U.S. competitiveness, increasing productivity and pushing up workers’ wages and standard of living, let it reduce aggregate uncertainty (including providing reassurances about the protection of property rights) and minimize the systematic risks businesses face. In many areas (from occupational licensing to land use laws), it also makes sense to nudge state and local governments to slash the red tape that hinders labor mobility and start-ups. Doing these things will hold down the after-tax rate of return necessary for new projects to obtain private finance. After that, the most effective thing to do is to let the market choose.

As for employment patterns, here we do see a big challenge looming: the pace and mix of technological change. As we noted above, past productivity improvements have been the principal drivers for the shift of employment from agriculture to manufacturing to services. But, with the advent of ever-more-powerful computers, technologists insist that the pace of change is accelerating. That process could prove lumpy, rapidly displacing large groups of low- and medium-skilled workers in a short period. To give just one example, how long will it take for self-driving technology to replace nearly two million U.S. truck drivers? And, how will the government respond? Slamming innovators at MIT, Google and Tesla won’t be as politically rewarding as blaming China and Mexico.